How To Protect Your Account

Download Our Mobile App

Abacus Bank will NEVER request through email, text, or unsolicited phone call your bank card number, account number, Social Security number, Personal Identification number (PIN) or password.

- Abacus Chip Debit Cards

- Features and Benefits

- How it Works

- Chip Debit Cards FAQs

Abacus Bank Debit Cards are adding convenience and security to your Payments!

![]()

![]()

Abacus Chip debit cards with built-in chip technology, it provides an additional layer of security as every time a chip card is used in-store at a chip-activated terminal, a unique one-time code is generated that's used to approve the transaction. This feature prevents the fraudster to duplicate counterfeit cards, helping to reduce in-store fraud.

The Features and Benefits of Abacus Debit Cards

The Abacus MasterCard Debit Card is a convenient, fast and secure way to pay for all your everyday purchases without the hassle of writing checks. Your card is honored at merchants worldwide. The money for your purchases is deducted from your Abacus primary checking account. You can use your card to automatically pay many of your recurring monthly bills, like Internet access, insurance payments and utility bills. Get convenient 24-hour access to your account with easy access to thousands of ATMs.

With your Abacus MasterCard Debit Card, you can access your money at millions of ATMs all over the world.

And also with Abacus MasterCard Debit Card, you are able to waive the monthly maintenance service charge on your Everyday Checking account by 3 debit card purchases per month.1

In addition to the existing benefits of the Abacus MasterCard Debit Card, you can enjoy more benefits with this new chip technology:

- The chip card provides increased data protection.

- The chip card is easy to use at chip enabled POS terminals.

- There is no additional cost to receive a chip card.

- You still enjoy the same benefits you do today.

Abacus Bank is bringing chip technology to you as a commitment to your security. We want to be your first choice for all your banking needs. Abacus will provide you deposit services, investment choices, insurance, credit cards and loans that best suit you and your family’s needs. As you grow, we will grow with you, every step of the way.

How it Works

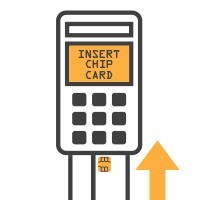

Your Abacus Chip Debit Cards are not only more secure - they are also easy to use.

|

1. Insert the chip end of your card into the terminal with the chip facing up (instead of swiping). |

|

2. Keep your card in the terminal throughout the transaction and follow the prompts on screen. |

|

3. Remove your card when prompted and take your receipt. |

For your convenience, your card still has a magnetic stripe so you can swipe when needed.

Abacus Chip Debit Cards FAQs

A chip card is a standard-size plastic debit or credit card that contains an embedded microchip, as well as the traditional magnetic stripe. The chip protects in-store payments because it generates a unique, one-time code that is needed for each transaction to be approved. It is virtually impossible for fraudsters to replicate this feature in counterfeit cards, providing you greater security and peace of mind when making transactions at a chip-enabled terminal.

No, you may hear chip cards referred to as "smart cards" or "EMV™ cards" – they are all different ways of referring to the same type of card. Similarly, an EMV terminal is the same as a chip-enabled terminal.

As chip technology will soon become the security standard in the U.S., many merchants are beginning to accept chip cards and we want you to be ready. You'll have greater security when making purchases at a chip-enabled terminal since the chip provides better protection against counterfeit fraud. Chip technology is already used in over 130 countries around the world, including Canada, Mexico and the United Kingdom. But use of your Abacus Debit Cards maybe restricted in certain international transactions due to security risks. Please contact Bank for details.

It's easy. If the retailer has a chip-enabled terminal, simply insert the chip end of your card face up into the terminal. The chip card will remain in the terminal while the transaction is processed. To authorize your transaction, just follow the prompts as you do today.

You'll be prompted to enter your PIN or to provide a signature as you normally would to verify the transaction. Your card will remain in the terminal until the transaction is completed.

If the retailer is not equipped to read the chip card, just swipe as you do today. However, if you swipe your chip card at a chip-enabled terminal, the terminal may prompt you to insert your chip card into the terminal. Transactions made over the phone or online will not change.

All of our cards are safe, and offer protection from unauthorized use of your card or account information. Chip technology offers another layer of security when used at a chip-reading terminal, because it generates a unique, one-time code that is needed for each transaction to be approved.

Yes, you can still make purchases as you always have — by entering the card number online or swiping your card at merchant locations that do not yet have chip readers. You can also continue to use your card at ATMs.

No. Not all merchants have chip-enabled terminals, Merchant adoption will increase over time, so you card still has a magnetic stripe on the back, allowing you to swipe as you normally would at non chip-enabled terminals.

Yes. Chip technology has been around for over two decades and is already the security standard in many countries around the world. When purchases are made using the chip feature, the transaction is more secure because of a unique process that is used to determine if the card is authentic. This makes the card more difficult to counterfeit or copy.

While magnetic stripe cards are still considered secure, chip technology is the next step to providing enhanced security to our customers. Whether you use the magnetic stripe or the chip to make your purchase, you can have confidence in the protection and security features we provide for all debit card accounts.

Remember, if you notice any suspicious activity on your account, notify us immediately by calling the number on the back of your card.

No. Chip card technology is not a locator system. The chip on your card is limited to supporting authentication of card data when you make a purchase.

No. Instead of waving or tapping your card in front of a device as you do with contactless payments, a chip card must be inserted face up into a chip-enabled merchant terminal. Remember to leave your card inserted into the terminal while the transaction is processed.

Yes. You'll continue to enjoy the same benefits with your chip card as you do today with your debit card.

We recommend that you set a travel notice by contact us at 1-800-969-8423 on any card(s) you plan to use while traveling, so your card access isn't interrupted. For your protection, we'll continue to monitor card activity even when a travel notice is set. If you encounter any issues while traveling, we're here to help.

Yes. You can continue to use your card as you do today by following the instructions at an ATM.

Further Questions:

If you have questions about your new debit card or need assistance in any way, please contact us at 1-800-969-8423, or stop by your nearest branch.

1 Maintenance service charge on Abacus Everyday Checking account can be waived with minimum 3 debit card purchases per month. Please contact a banker for more information.

“PayPass” is a trademark owned by MasterCard International Incorporated.

“payWave” is a trademark owned by Visa, Inc.